What is Neutrl?

Neutrl: Scalable, Market-Neutral Synthetic Dollar

Neutrl is a market-neutral synthetic dollar designed to unlock untapped yield opportunities in OTC and altcoin markets. Neutrl leverages OTC arbitrage, funding rate inefficiencies, and DeFi-native market-neutral strategies to provide a single, high-yield access point for capital allocators.

How Neutrl Works

Yield Generation with Market Neutrality

Neutrl creates a synthetic dollar, NUSD, that captures asymmetric yield opportunities while maintaining market neutrality. This is achieved through:

- OTC Arbitrage:

Neutrl acquires crypto assets at deep discounts through OTC deals, with enforced onchain settlement via smart contracts or qualified custodians. These are then hedged using perpetual futures, capturing unmatched yield potential. - Delta-Neutral Hedging:

To stabilize NUSD's value, Neutrl uses derivatives to hedge market exposure. This ensures that NUSD maintains a stable value relative to its backing assets, regardless of market trends.

Basis and Funding Arbitrage

Neutrl leverages basis arbitrage opportunities in perpetual futures markets to generate additional yield:

- What is Basis Arbitrage?

In perpetual futures markets, the futures price of an asset often deviates from its spot price due to supply and demand imbalances, called a "basis spread". Neutrl capitalizes on this spread by simultaneously holding a long position in the spot market and a short position in the futures market. - Funding Rate Arbitrage:

Perpetual futures contracts require traders to pay or receive funding fees to maintain price parity with the spot market. Neutrl takes advantage of this by capturing positive funding rates, where short positions (held by the protocol) receive periodic payments from traders holding long positions. - Market Neutral Strategy:

By combining spot and futures positions, Neutrl eliminates directional risk while generating consistent returns from the basis spread and funding rate payments. This approach ensures that yield is earned regardless of whether the market moves up or down.

Key Features of NUSD

- Fully-Backed Synthetic Dollar:

NUSD is fully backed by a diversified portfolio, offering a higher margin of safety compared to traditional basis trades. OTC discounts enhance the protocol's stability and yield potential. - Free to Use in CeFi and DeFi:

NUSD integrates seamlessly across both CeFi and DeFi ecosystems, with high composability for use cases such as lending, trading, and liquidity provision. - Peg Stability Mechanism:

The protocol maintains NUSD's peg by using delta hedging derivatives against its backing assets. This stabilizes NUSD while capturing yield from spot crypto assets and futures markets.

Neutrl's NUSD is not the same as a fiat stablecoin like USDC or USDT. NUSD is a synthetic dollar, backed with crypto assets, liquid synthetic dollars and corresponding short futures positions. This means that the risks implicated by interacting with NUSD are inherently different. Please refer to our extensive Risks Section for more information.

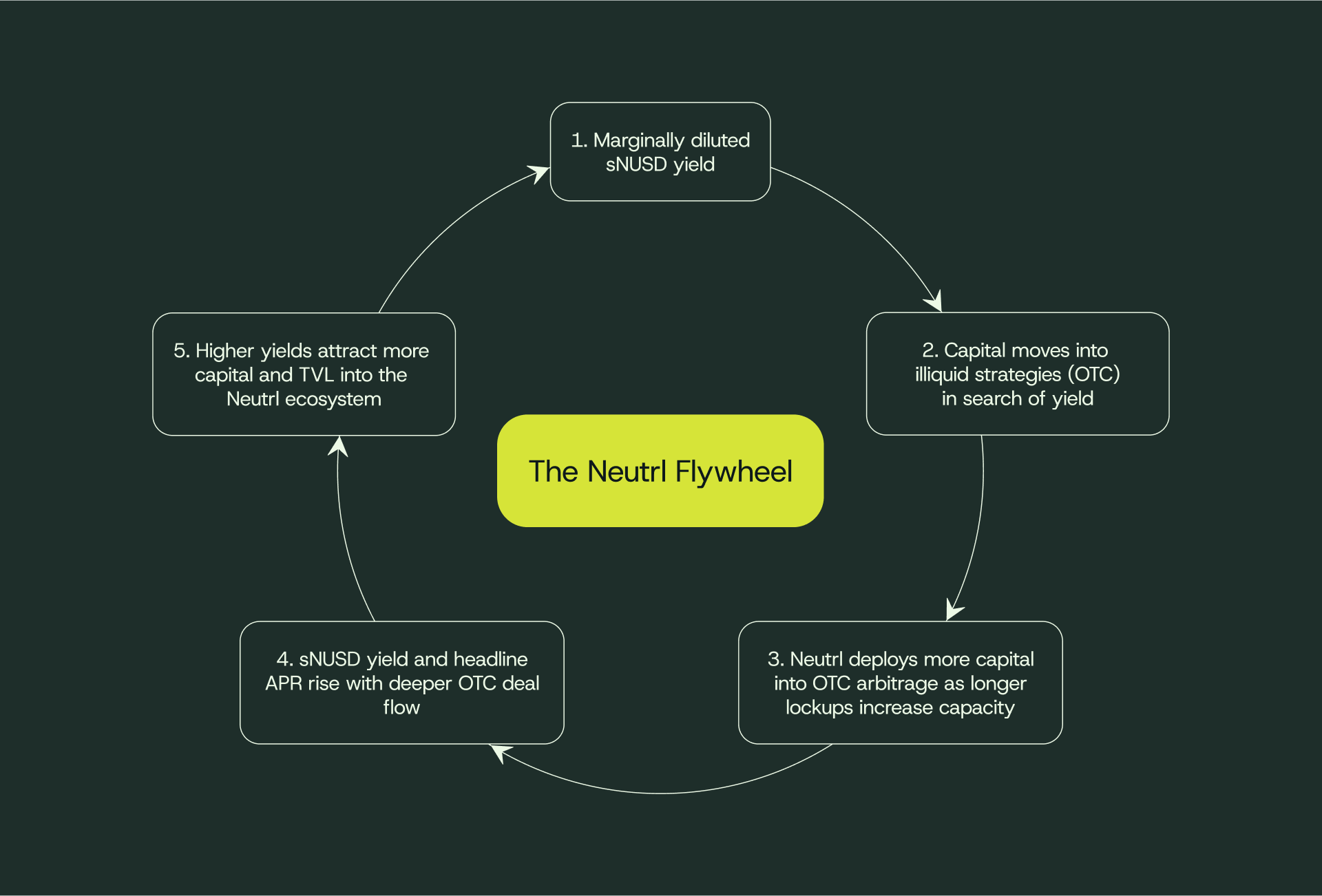

The Neutrl Flywheel Effect

A powerful positive flywheel powers Neutrl's TVL growth, stickiness and increased yields

When new NUSD flows in, sNUSD's headline yield is marginally diluted, and starts the flywheel effect as capital seeks higher returns:

Yield Compression

As yield compresses, investors seek out higher yielding and riskier opportunities. As liquid APY drifts toward the onchain cash-equivalent rate, yield-seekers look for higher yield. They may stake their NUSD, convert to sNUSD, or extend their existing locks to 6-, 9- or 12-month terms.

Longer Lock Durations

Longer lock durations unlock more opportunities. With more capital allocated to longer terms, the protocol can deploy into more and larger OTC and basis arbitrage opportunities that are more viable at scale.

Higher Deployment

Higher deployment increases APY. Higher returns flow back into the yield pool, automatically reindexing sNUSD and increasing APY.

Increased Yield

Increased yield attract new deposits. As yields rise, they attract a new wave of deposits, increasing TVL and restarting the cycle.

This positive feedback loop continues until the market exhausts attractive longer-tenor opportunities. Because the flywheel mechanism is fully automated—without discretionary adjustments or human committees—Neutrl can navigate volatile market conditions while maintaining smooth redemptions and competitive yields. Increased deposits expand capacity, higher capacity raises yields, and rising yields attract further deposits.