Protocol Revenue

Protocol Revenue and Distribution Model

The protocol generates revenue from diversified strategies designed to optimize risk-adjusted returns while ensuring sNUSD holders benefit from stable and predictable yields. The primary revenue streams are as follows:

Hedged OTC Deal Discounts

Mechanism: The protocol acquires crypto assets at significant discounts through OTC transactions. These assets may include locked tokens, which are hedged to mitigate price risk, or liquid tokens, which can be deployed immediately.

Revenue Generation: The discount creates an immediate unrealized gain, while hedging ensures the portfolio remains delta-neutral. Locked tokens may further generate staking yields.

Delta-Neutral Yield Strategies

Mechanism: The protocol deploys a portion of the collateral into delta-neutral strategies, such as perpetual futures funding arbitrage and basis trading. These strategies capture yield by exploiting inefficiencies in derivatives markets while neutralizing directional price risk.

Revenue Generation: Yield is earned from funding rate differentials or price spreads without exposing the portfolio to market volatility.

Yield-Bearing Stablecoins

Mechanism: A portion of the protocol's reserves is allocated to yield-bearing stablecoins or earning the cash-equivalent rate, which track the overnight "tradfi" risk-free interest rate.

Revenue Generation: These positions generate predictable and low-risk yield, which serves as the primary reserves for redemptions and capital requirements.

How Revenue is Distributed

The protocol ensures that revenue generated from its various strategies is distributed fairly and efficiently to sNUSD holders, aligning incentives between short-term stability and long-term protocol growth. The distribution process involves two key components:

NUSD Holders

Mechanism: NUSD holders do not receive any yield. However, NUSD is fully redeemable 1:1 for USDC at any time by approved counterparties. This guarantees that NUSD functions as a stable and reliable store of value.

Rationale: By focusing on stability and liquidity, NUSD provides holders with confidence in its peg and ease of redemption, making it an ideal synthetic dollar for everyday use or passive holding.

Staking for sNUSD

Mechanism: To access the yield generated by the protocol's revenue streams, NUSD holders must stake their tokens to receive sNUSD. sNUSD holders benefit from the protocol's broader revenue streams, including profits from OTC deal discounts and delta-neutral strategies.

Why Staking is Required:- Staking aligns incentives by encouraging holders to lock their capital and participate in the protocol's growth.

- It also allows the protocol to better manage liquidity and allocate resources efficiently.

Revenue Distribution Model

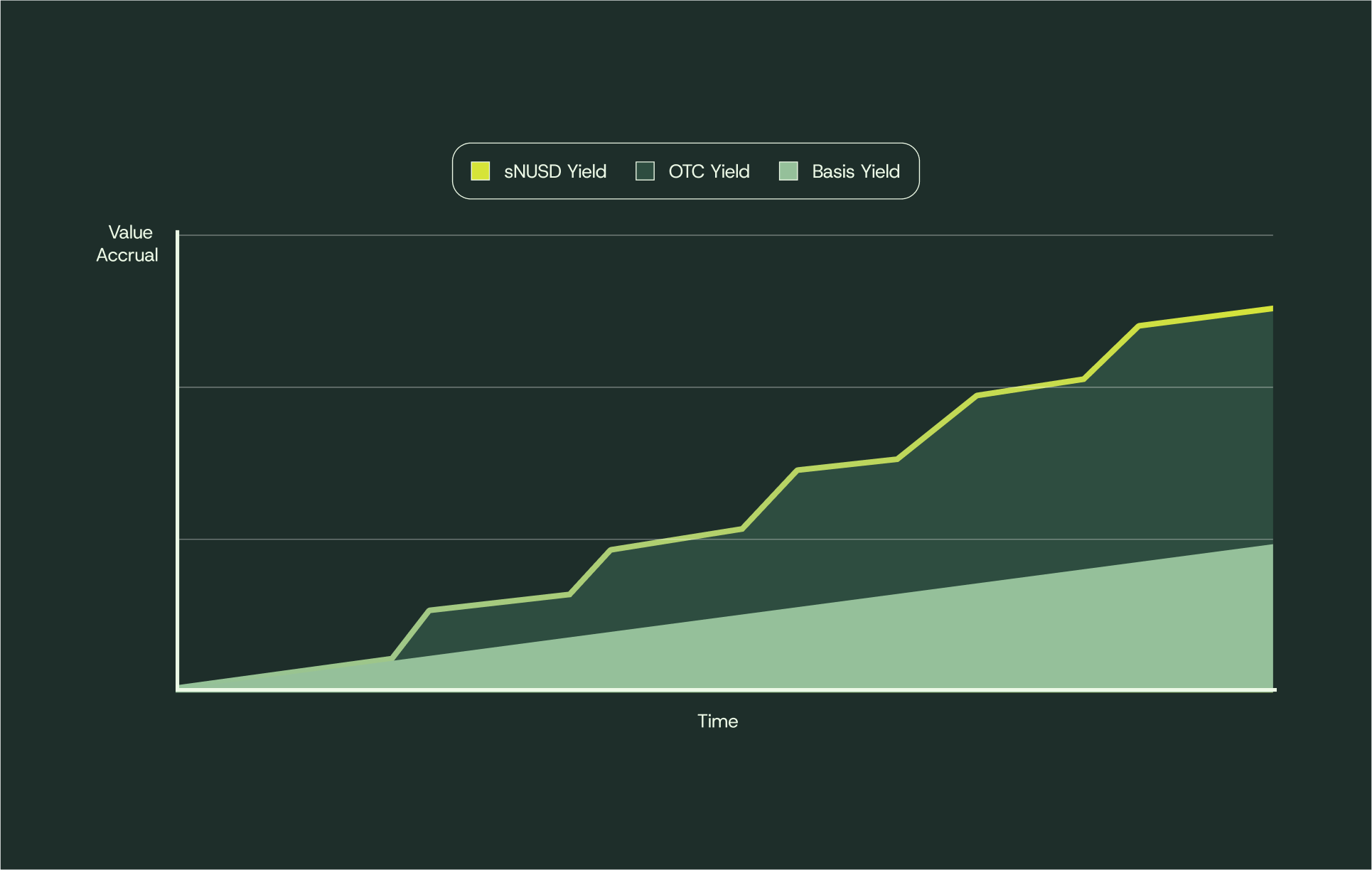

All yield generated by the protocol accrues directly to sNUSD, increasing its value relative to NUSD over time. This applies to both short-term and long-term revenue sources. In addition, OTC arbitrage profits and other potentially illiquid strategies may have lumpy return profiles and as a result Neutrl reserves the right to smoothen out these windfalls for sNUSD holders at its discretion over the course of days or weeks. Pacing will depend on factors including relative size of profits relative to overall book size, current staking/redemption flow and prevailing yield conditions in the market.

Protocol revenue flows from diverse strategies accrue to sNUSD holders through appreciation of the exchange rate

Short-Maturity Yields:

- Sources:

- Revenue from liquid and short-term instruments, such as:

- Delta-neutral strategies (e.g., funding rate arbitrage, basis trading)

- Yield-bearing stablecoins

- Secondary market sales of OTC-acquired assets

- Revenue from liquid and short-term instruments, such as:

- Distribution:

- These yields accrue to sNUSD, increasing its exchange value compared to NUSD

- Example: If the protocol earns $1M in profits from delta-neutral strategies, this revenue is reflected in the increasing value of sNUSD

Long-Maturity Yields:

- Sources:

- Revenue from longer-term hedged locked tokens acquired via OTC deals

- Distribution:

- These yields also accrue to sNUSD, with the underlying dollar-denominated yield retained in the protocol treasury

- The appreciation in value is reflected in the sNUSD/NUSD exchange rate

- Rationale:

- By accruing long-term yields to sNUSD, the protocol aligns stakers with its success

- The protocol retains reserve assets to build capital buffers for times of market stress

Dynamic Yield Accrual

The overall yield accrued to sNUSD depends on the maturity profile of the protocol's revenue streams:

High Liquidity Periods:

- When the protocol's revenue is primarily generated from short-term strategies, yield accrual to sNUSD will be more immediate and predictable

Long-Term Growth Periods:

- When revenue is skewed toward long-term yield (e.g., locked tokens), yield accrual will reflect a longer-term appreciation profile

- This dynamic accrual model ensures flexibility, balancing short-term liquidity needs with long-term growth objectives

Example of Revenue Flow and Distribution

Revenue Generation:- The protocol earns $800K from delta-neutral strategies, $200K from short-term cash-equivalent (reference) yields, and $500K in unrealized gains from locked tokens acquired via OTC deals.

- The $1M from delta-neutral strategies and cash-equivalent yield accrues to sNUSD holders through an increase in the sNUSD/NUSD exchange rate

- The $500K in locked token gains also accrues to sNUSD value, with the dollar value of the locked tokens retained in the protocol treasury

- Stakers benefit from the full yield generated by the protocol through a continuously appreciating sNUSD value relative to NUSD

- This maximizes both immediate returns and exposure to protocol growth

Key Benefits of the Distribution Model

Fairness and Flexibility:- The model ensures all yields, both short-term and long-term, accrue directly to stakers through sNUSD appreciation

- Retaining long-term yields in the treasury strengthens the protocol's reserves, ensuring stability and liquidity during market stress

- Stakers benefit directly from protocol growth through sNUSD appreciation, fostering long-term participation and alignment with the protocol's success

- By requiring staking for additional yield, the protocol can better manage liquidity and ensure efficient capital allocation