How Neutrl Works

Typical Neutrl user flow: 1) Deposit → mint nUSD 2) Stake → earn sNUSD yield 3) Lock → boost rewards.

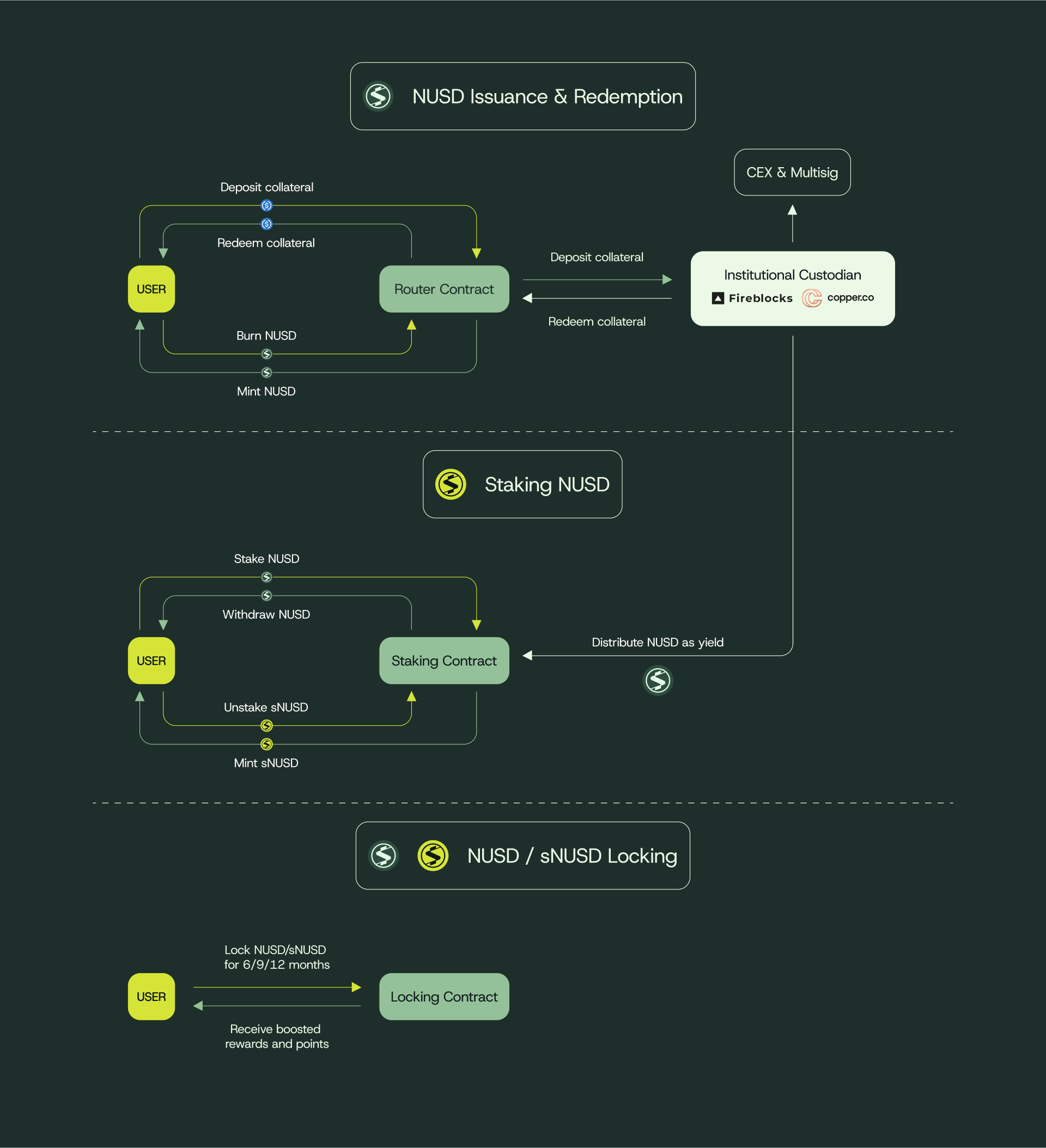

NUSD Issuance & Redemption

Deposit collateral

- Eligible assets: USDC, USDT, USDe

- Any time you deposit one of these tokens to the Router Contract, the system settles your deposit onchain.

Receive the receipt token

- The router mints NUSD 1 : 1 against your collateral and returns it to your wallet in the same transaction.

Institutional custody & deployment

- Collateral routes to segregated vaults at institutional custodians (Fireblocks, Copper, Ceffu etc.).

- From there it is deployed into delta-neutral, duration-matched strategies that power the protocol's yield engine.

Unmatched liquidity

- NUSD is an ERC20, with plug-and-play across CEX margin accounts, DeFi money-markets and onchain primitives.

- Fast redemptions plus full backing make it “blue-chip” collateral wherever dollars are needed.

Staking NUSD → sNUSD

Stake

- Stake your NUSD into the Staking Contract to convert it into sNUSD.

Earn the Neutrl rate

- All protocol income - basis arbitrage, OTC carry, onchain reference yield pools - flows to the yield pool.

- Every epoch the pool re-indexes sNUSD balances upward

Locking NUSD / sNUSD / LP tokens

Choose a lock tenor

- Lock assets for 6 to 12 months inside the Locking Contract.

Boost your rewards

- Longer locks earn higher points → a larger slice of future emissions & incentive campaigns.

Future-proof distribution

- The protocol may evolve to a weighted-average maturity model, seamlessly routing more yield toward longer-dated lockers to keep duration perfectly balanced.